Overview

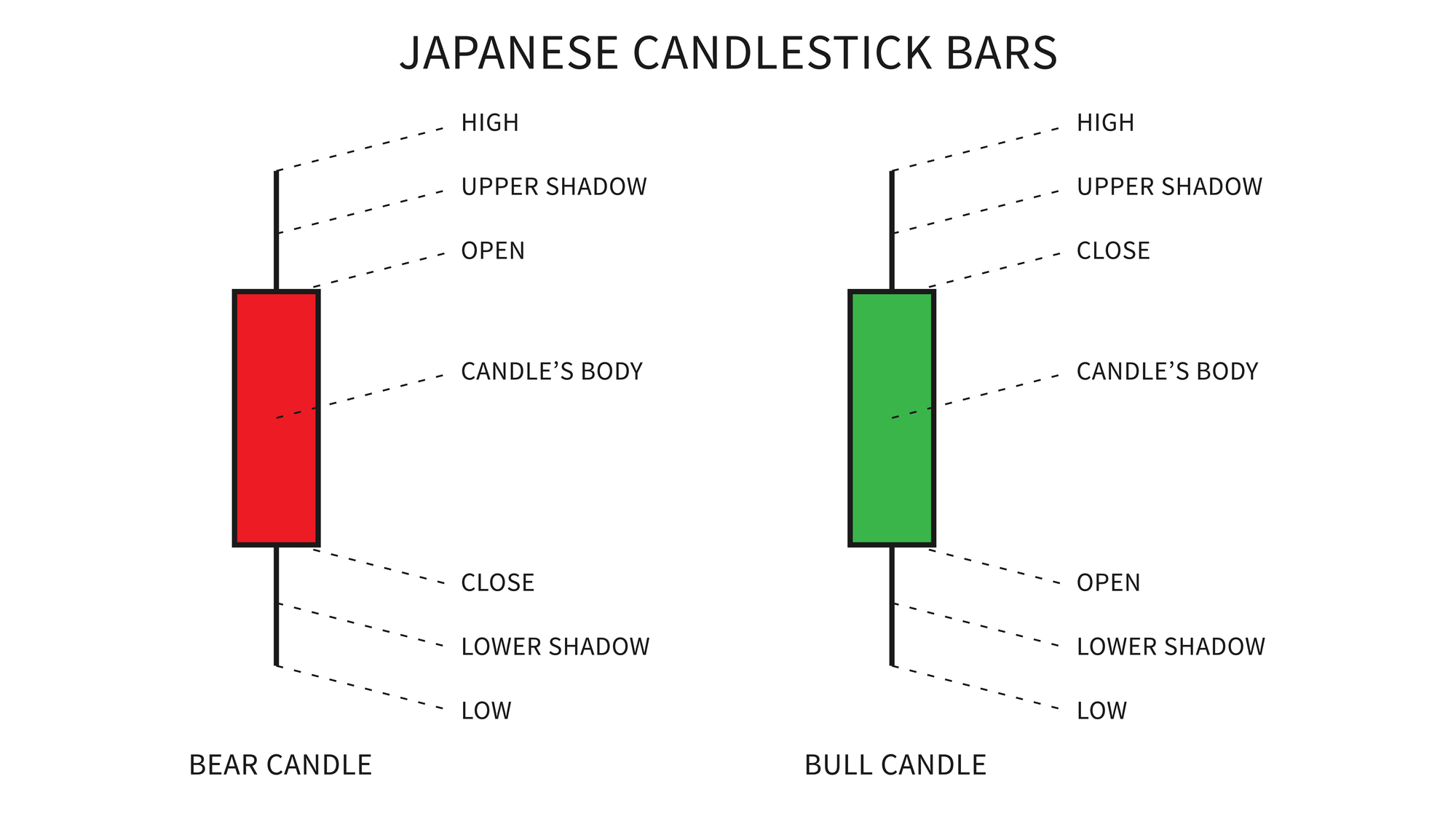

Candlesticks are a very fundamental and powerful tool in technical analysis. They provide us with insight on market conditions and sentiment. They contain a deadly combination of factors: They show the opening price, the closing price, the highest price and the lowest price in a given time frame in a given asset, and combined with the volume data, they may be used to determine price reversals as well as long-term trends. Candlesticks emerged in the 17th century in Japan and it is believed that they were used primarily by rice traders. Over time they became the very basis of Japanese trading philosophy, and during the 1990s they were introduced to the west and ever since became the basis of trading worldwide. Nowadays they may be found in every trading platform and are very popular among traders of all assets.

Course Features

- Lectures 13

- Quizzes 0

- Language English

- Students 2

- Assessments Yes

Reviews

Reviews

Average Rating

Detailed Rating

Curriculum

-

Understanding Candlesticks 13

-

CandlesticksLecture1.1

-

Doji Candlestick in ForexLecture1.2

-

Marubazu Candlestick in ForexLecture1.3

-

Hammer and Hanging Man CandlesticksLecture1.4

-

Shooting Star and Inverted Hammer CandlestickLecture1.5

-

Bullish piercing patternLecture1.6

-

Dark Cloud Cover PatternLecture1.7

-

Bullish and Bearish engulfing patternsLecture1.8

-

Tweezer Tops and BottomsLecture1.9

-

Morning and Evening Star PatternsLecture1.10

-

3 White Soldiers 3 Black CrowsLecture1.11

-

3 insideup 3 inside down patternLecture1.12

-

Rising and Falling Three MethodsLecture1.13

-