Overview

The Foreign Exchange Market, also known as the Forex market is the biggest financial market in the world with an estimated four trillion dollars exchanging hands every day. As this Market is so liquid it allows for the buying and selling of foreign exchange at any given second. It allows very high Leverage, releasing the potential of high-risk trading, and a plethora of sophisticated financial products based on Foreign Exchange. Like trading any asset in the financial markets, it is important to know want you’re dealing with and get acquainted with various tools that are available to do so. There are many brokers in the Forex Market and many trading platforms one may choose to trade through. Every one of these options requires some thought as there are, in many cases, severe implications. As the Forex Market is the biggest and most popular in the world there are accordingly the lowest fees when entering and exiting the market than in any other Financial Market, thus adding to the Forex Market’s appeal.

In this lesson we will learn the very basics of trading Forex.

What does it mean to buy one currency and sell the other?

How best should one utilize the tool of leverage?

When should one enter a Forex deal and is there an ideal time to exit a Forex deal?

What are the implications of interest rates in every conducted deal?

How do I know if I want to trade short-term or long-term?

How can I gain an advantage over other traders?

How do the banks control and manipulate currency value?

How can one understand the meaning of technical indicators?

How might I interpret the financial news an economic data and keep up with the economic calendar?

Who are the major players in this market and what is their share of the global turnover?

Course Features

- Lectures 12

- Quizzes 0

- Language English

- Students 3

- Assessments Yes

Reviews

Reviews

Average Rating

Detailed Rating

Curriculum

-

Basic Forex Education 12

-

Why Trade Forex?Lecture1.1

-

When to trade ForexLecture1.2

-

Trading Terminology Or Where Am I Going LongLecture1.3

-

How To Trade With LeverageLecture1.4

-

Whats a PIPLecture1.5

-

How To Place A Trade In ForexLecture1.6

-

Types of Forex OrdersLecture1.7

-

Technical Analysis In ForexLecture1.8

-

Fundamental Analysis in ForexLecture1.9

-

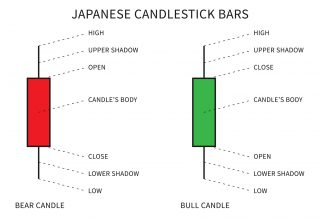

Types of forex chartsLecture1.10

-

Support and Resistance in ForexLecture1.11

-

TrendlinesLecture1.12

-